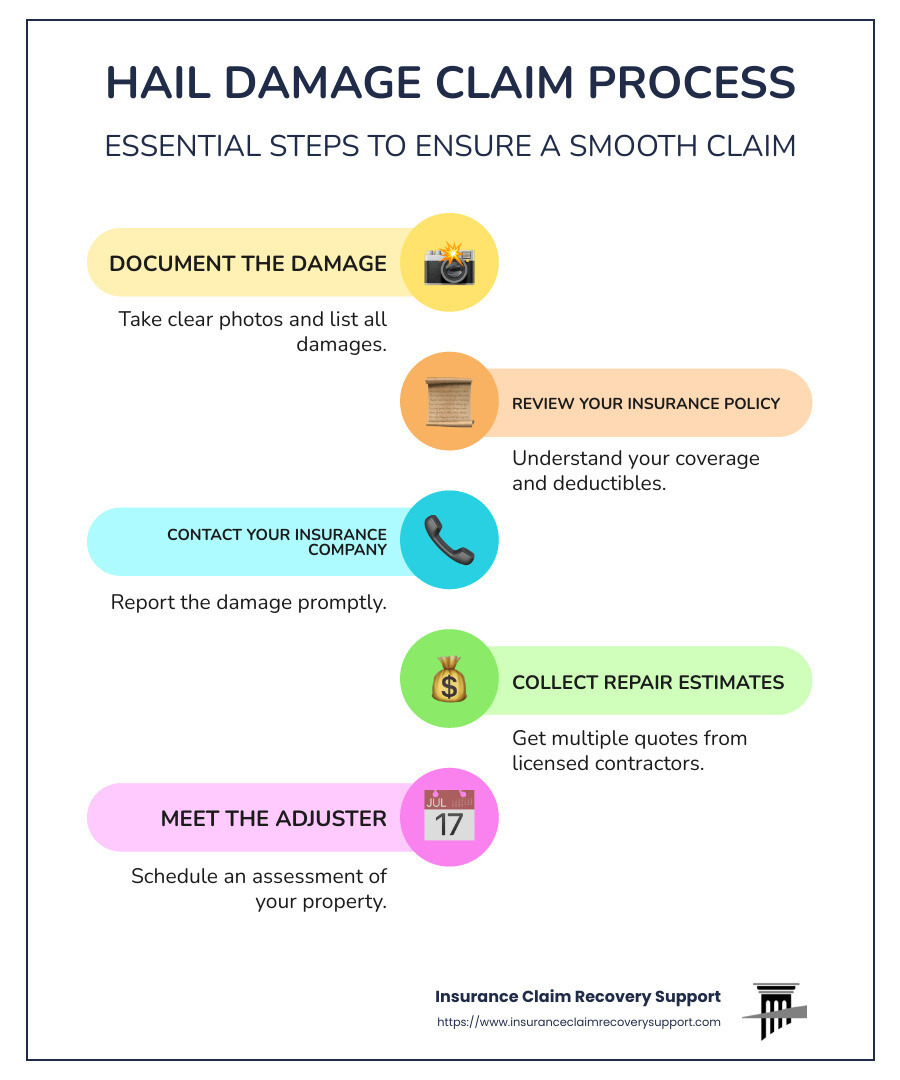

Exactly How To Accelerate A Lawsuit Samer Habbas & Affiliates It can likewise protect against lengthy troubles such as an insurance provider declaring a pre-existing problem or insurance coverage fraudulence. If your insurance company isn't acting in great confidence by rejecting or postponing your case without reason, think about working with an insurance coverage claim attorney. They can help test the insurance provider's decision and guarantee you obtain the compensation you're entitled to. A legal representative can likewise help hold the insurance policy service provider answerable if they are acting unjustly. A lawyer experienced in taking care of refuted or postponed claims can promote for you and aid guarantee that you obtain the full payment you're entitled to under your vehicle insurance policy. By understanding the timeframe in which your insurance service provider must act, you can be much better prepared to challenge a delayed claim. If the insurance company doesn't fulfill the lawful target dates, they might deal with charges or be needed to pay you added damages for the delay. In some cases, rejected insurance claims can be resolved by providing more details or dealing with blunders. A need letter is a formal created request from the claimant's lawyer to the offender's lawyer or insurance provider. It lays out the plaintiff's variation of events, their injuries, the damages they have suffered, and the compensation they look for. A need letter initiates settlement arrangements between the plaintiff and the defendant. Filing a problem with the commissioner can help you obtain the insurance provider to progress with your claim. In many cases, the commissioner's treatment might prompt the insurance supplier to settle the delay faster. This protest will certainly also create a record of the unreasonable hold-up, which could support your instance if you need to go after lawsuit. Each state has legislations that regulate exactly how rapidly an insurer have to refine and pay out insurance claims. Comprehending these laws can give you a clear idea of whether the insurance supplier is acting within the legal time frame. Declaring mistakes or submitting insufficient info can also cause a rejected insurance claim.

McAllen Property Damage Lawyer

Negotiations Vs Trial: Which Is Much Faster?

What are the downsides of employing an attorney?

Lawful Charges: One unfavorable element of working with an attorney is the easy reality that you will certainly need to pay them. You and your attorney will certainly work out their fee prior to hiring them, yet specific circumstances could arise throughout your situation that may lead to a higher outcome, which eventually is what you are paying for.

Reduced Legal Costs

Claimants who do not fully recognize their claim's value might be tempted to promptly accept these low deals. As a result, these instances are much less most likely to work out quickly and typically necessitate a trial to deal with the issues. As the test date approaches, both events might feel enhanced pressure to resolve to prevent the unpredictabilities and costs of a test.Gather Paperwork And Documentation For Your Situation

- While we strive to make sure accuracy, some details might be dated, incomplete, or no more relevant.If your situation includes substantial damages, you may be asking yourself, "why is my legal representative taking so long to settle my instance?We can document and existing engaging evidence to the SSA to justify the demand for a quicker hearing day.Their knowledge with local lawful systems is a very useful possession in speeding up claims and avoiding step-by-step obstacles.